Disclaimer: this article was published before the Big Beautiful Bill was signed. All the rebates described in the article will cease to exist in 2026. If you would like to make the most out of the tax credit and federal rebates, contact our team today.

Your Complete Homeowner Guide

By the Airmatics team — serving Plano, Frisco, Dallas, McKinney, Allen, Southlake, Grapevine, Lewisville, Irving & Carrollton

Quick help: Wondering if a heat pump makes sense for your home — and how the 2025 tax rebate works? This guide explains the Heat Pump Tax Rebate, Federal Tax Credits for Energy Efficiency (IRC §25C), how to use IRS Form 5695, and how to stack Texas utility rebates so you pay less upfront and less on every bill.

Don’t Miss the 2025 Window: Install a Heat Pump and Save

Texas weather keeps your HVAC busy — triple‑digit summers and chilly North Texas snaps. If your system is older, loud, or uneven, you’re probably weighing a replacement and asking: “Can I get a real tax rebate for a heat pump in 2025?”. The short answer is yes — and if we get this done before December 31, 2025, you can combine federal tax credits with local utility rebates to save thousands.

At Airmatics, we’re a local, certified HVAC contractor. We install and service Trane, Cooper&Hunter, Runtru by Trane (and others), design right‑sized systems, and handle the paperwork homeowners worry about — rebates, model certifications, and the line items your tax pro needs for Form 5695.

We’re here to help

Schedule your free estimate — Plano • Frisco • Dallas • Allen • McKinney • Southlake • Grapevine • Lewisville • Irving • Carrollton

Talk to a local HVAC pro before the busy season. We’ll confirm your eligibility, run the heat‑load math, price out Trane / Cooper&Hunter / Runtru options, and handle the rebate paperwork.

CALL US TODAY FOR A HEAT PUMP INSTALL

What exactly is the Heat Pump Tax Rebate (a.k.a. §25C credit)?

Think of §25C as a federal tax credit that pays you back for part of a qualifying energy‑efficient upgrade. For air-source heat pumps, the credit is 30% of your eligible project cost, capped at $2,000 per year. You can also use up to $1,200 more for other upgrades (insulation, windows, etc.), so the total possible federal savings in one year can reach $3,200.

Deadline Alert: Install by December 31, 2025 to qualify for the federal heat pump tax credit (30% up to $2,000).

Don’t wait until the busy season – schedule your consultation early.

Heat Pump Tax Credit Key Points:

- A tax credit directly reduces tax owed. If you owe $3,000 and qualify for a $2,000 credit, you now owe $1,000. (It’s not a refund beyond what you owe.)

- The project includes equipment and installation labor.

- The heat pump must be installed and placed in service by 12/31/2025.

- The unit must meet the ENERGY STAR® Most Efficient / top‑tier efficiency criteria. In 2025, the IRS also requires a Qualified Manufacturer/Product ID (QMID) that we include in your documentation.

- Your home must be your primary residence (existing home; not new construction; not a rental).

Airmatics tip: We’ll recommend models that clearly meet the 2025 criteria and provide the documentation package your tax preparer wants (invoice, AHRI/ENERGY STAR® model data, and the manufacturer certification/QMID reference).

Why Texans love heat pumps (comfort + savings)

If you’ve only ever had a gas furnace and a separate AC, a heat pump can sound mysterious. In simple terms, it’s one system that cools in summer and heats in winter by moving heat instead of burning fuel. In our climate, modern variable‑speed heat pumps are quiet, even‑temperature, and very efficient.

Everyday benefits you’ll feel:

Lower energy bills with high‑efficiency performance

Modern heat pumps use variable‑speed compressors and efficient motors to deliver more cooling or heating with less electricity. That high SEER2 rating (for cooling) and HSPF2 rating (for heating) translate into real savings compared to older 10–12 SEER systems. Many North Texas homeowners see a noticeable drop in summer bills right away because the new system doesn’t have to work as hard to keep them comfortable.

Better comfort and humidity control in Texas summers

Our summers are hot and humid, and comfort isn’t just about temperature. A variable‑speed heat pump runs longer at lower speeds, pulling more moisture from the air and keeping indoor humidity in a comfortable 45–55% range. Lower humidity means you can set the thermostat a degree or two higher and feel just as cool—saving energy without sacrificing comfort.

Gentle, even heat in North Texas winters

Instead of the “blast‑on/blast‑off” feel of some older furnaces, a heat pump delivers steady, even heat. Rooms warm up uniformly and stay that way, with fewer swings. On rare arctic fronts, we can design dual‑fuel (heat pump plus a high‑efficiency gas furnace) so you’re covered for every kind of Texas winter day.

Cleaner attic/closet space and healthier airflow

A replacement isn’t only about new equipment. We also address the little things that make a big difference: a fresh drain pan, float switch, properly pitched drain, and sealed ducts and plenums. Tighter ducts reduce dust and hot‑attic air leaks, improving airflow and indoor air quality while protecting your new investment.

Future‑ready for solar and smart rate plans

Heat pumps pair beautifully with solar PV, smart thermostats, and utility demand‑response programs. Many homeowners use pre‑cooling strategies or time‑of‑use plans to shift usage to cheaper hours. If you’re thinking about solar—or just want the option later—a high‑efficiency heat pump is the right foundation.

How the 2025 numbers usually pencil out

Below is a simple, realistic example for a 3‑ton central heat pump replacement in a typical North Texas home. (We’ll run the exact math for your address and utility service.)

| Item | USD Amount | Notes |

|---|---|---|

| Quoted installed price (high‑efficiency heat pump) | $7,000 | Includes labor, materials, and disposal |

| Utility rebate (example)* | −$700 | Most Texas utilities pay $400–$1,200, depending on size/efficiency |

| Net cost (before tax credit) | $6,300 | This is your eligible amount for the federal calculation if the $700 was an instant discount |

| Federal 25C heat pump credit (30% up to $2,000) | −$1,890 | 30% of $6,300; capped at $2,000 — this example is under the cap |

| Final estimated net | $4,410 | Plus lower energy bills each month |

* Exact rebate depends on your utility (Oncor, Austin Energy, CPS Energy, CoServ, etc.) and the model’s SEER2/HSPF2.

Good to know: If a rebate is paid after purchase (check/bill credit), it typically doesn’t reduce the amount you claim for the tax credit. If it’s taken as an instant discount on your invoice, we subtract it before calculating your 30%.

Texas utility rebates you can stack (2025)

Oncor (North/Central Texas): Residents in Plano, Frisco, Dallas, McKinney, Allen, and nearby cities typically access rebates through participating contractors like Airmatics. Incentives are seasonal and budget‑limited and generally reward higher SEER2/HSPF2 systems. We check availability and apply on your behalf.

Austin Energy: Residential heat pump rebates commonly start around $400–$500+ for qualifying central systems or mini‑splits when installed by a participating contractor. Austin Energy also offers programs like Home Energy Savings (whole‑home improvements) and Instant Savings for smart thermostats — good stackers when you time everything together.

CPS Energy (San Antonio): Rebates are usually per ton for central heat pumps and mini‑splits. In recent cycles, we’ve seen roughly $100–$275 per ton depending on efficiency and program year.

CoServ: Co‑op members north of Dallas can qualify for HVAC rebates tied to efficiency ratings; amounts vary year to year and require current forms.

Airmatics tip: Utility programs change annually and sometimes mid‑year when funds run low. We pull the current rules during your estimate so you know exactly what’s available that week.

The paperwork: what your tax pro needs (and what we provide)

No one loves paperwork — we make it easier.

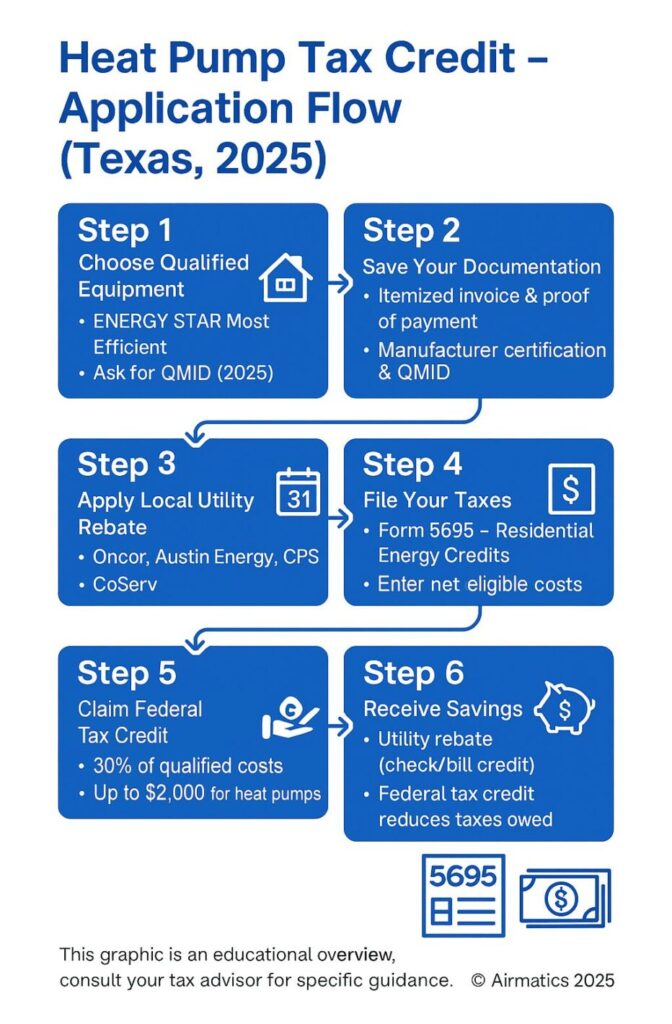

Heat Pump Tax Credit — Application Flow (Texas, 2025). From choosing a qualifying unit to filing IRS Form 5695 and receiving savings.

After installation, we prepare a digital packet you can hand to your CPA or upload to your DIY tax software:

- Itemized invoice and proof of payment

- Model numbers with AHRI/ENERGY STAR® data sheet

- Manufacturer certification / QMID reference for 2025

- Thermostat and other eligible items (if required by your utility)

- Rebate confirmation (if the program issues one)

When you file taxes, you or your preparer complete IRS Form 5695 (Residential Energy Credits). For heat pumps, the credit appears on Part II and flows through to reduce your tax owed.

Do heat pumps really heat well in North Texas?

Yes. Today’s variable‑speed heat pumps are designed for mild to moderate winters like ours. We also install dual‑fuel configurations (heat pump + high‑efficiency gas furnace) when a home has unusual heat loss or a homeowner prefers gas backup for rare arctic events. We’ll walk you through the right choice for your home.

Signs your current system is ready for an upgrade:

- Unit older than ~12 years with rising repair costs

- Hot/cold spots, long runtimes, or noisy starts

- Summer bills are climbing even after coil cleaning and new filters

- Cracked heat exchanger concerns, or short‑cycling in winter

Brands we trust (and why)

We install, service, and maintain Trane, Cooper&Hunter, Runtru by Trane, and others. Each has high‑efficiency models that meet the Most Efficient criteria needed for the Heat Pumps Tax Credit in 2025. Differences come down to modulation range, warranty, and budget. We’ll show you good/better/best options so you can choose confidently.

Step‑by‑step: how we’ll get you from quote to credit

- In‑home assessment & load calculation. We measure your home (rooms, windows, attic) and discuss comfort issues.

- Model selection. We present qualified options (with the QMID requirement for 2025), rebates, and lifetime cost comparisons.

- Permits & scheduling. We aim for a 1‑day install on most replacements; duct corrections may add a day.

- Installation day. Careful removal, pad/stand, line set checks, evacuation, charge by weight/subcool, startup, and homeowner walkthrough.

- Paperwork packet. You’ll get your PDF packet with all the data for IRS Form 5695 plus any utility forms.

- Follow‑up & maintenance. Join our maintenance plan for priority service before the Texas summer rush and during winter cold spells.

Common questions we hear (and straight answers)

Right now, plan as if 2025 is the last year for the current heat pump tax credit rules. We keep an eye on policy updates, and we’ll tell you if anything changes, but waiting on Congress is risky if your system is already struggling. Practically speaking, the smartest move is to choose a qualifying unit and get it installed and placed in service before December 31, 2025. That locks in the credit under today’s rules and protects you from potential changes next year.

From a scheduling standpoint, Texas summers get busy. Lead times grow, utility funds can run low, and installers book out. If you want the federal credit, it’s better to start the process now so you’re not squeezed by end‑of‑year bottlenecks.

Most Texas utilities fund rebates on a program‑year budget. When funds are used up, amounts may drop or the program may pause until the next cycle. That’s why we verify your service address and pull current program rules during your estimate. If funds are tight, we’ll recommend the right timing or an alternate qualifying configuration to help you capture what’s available.

Remember, the utility rebate is just one piece of the pie. Even if a local rebate ends, the federal tax credit is still substantial, and the monthly bill savings from a high‑efficiency heat pump continue year after year.

Yes. Ductless heat pumps (mini‑splits) can qualify the same way central heat pumps do—as long as the selected indoor/outdoor combination meets the required ENERGY STAR® Most Efficient / CEE top‑tier efficiency criteria. Many mini‑split systems excel in part‑load efficiency, which is perfect for Texas homes that need targeted comfort in bonus rooms, sunrooms, garages, or upstairs additions.

If you’re adding comfort to one or two hard‑to‑condition spaces, a mini‑split may be the most cost‑effective path: it avoids ductwork changes, improves comfort exactly where you need it, and can still unlock federal incentives and, in many territories, utility rebates.

You generally can’t claim two federal benefits on the same item. That means if you take a future HEEHRA point‑of‑sale rebate for the heat pump itself, you typically would not also claim the §25C heat pump credit for that same unit. However, you can still combine utility rebates with §25C today, and in a whole‑home project, you might mix and match measures—claiming §25C for the heat pump while using HOMES (once active in Texas) for insulation or air‑sealing if that’s how the state program is structured.

Bottom line: there will be options, but the cleanest path in 2025 is usually §25C + local utility rebate. We’ll review scenarios during your estimate so you can pick the stack that delivers the most value for your home and income level.

Not always. Many North Texas homes have adequate electrical capacity for a modern heat pump, especially if we’re replacing an older electric furnace/AC pair. During your in‑home assessment, we inspect the service size, breaker spaces, wire sizes, and grounding. If an upgrade is needed, we’ll price it in your proposal and discuss whether a separate electrical credit could apply based on the year’s rules.

A quick note on comfort and cost: sometimes we can specify a right‑sized, variable‑speed system that avoids panel work while still delivering excellent comfort. We’ll design for performance first, then confirm the electrical details so there are no surprises.

Don’t miss the deadline

Install a Heat Pump by December 31, 2025, to claim the federal Tax Credit. Airmatics can help you stack 2025 Tax Rebates, complete IRS Form 5695, and pick an efficient, quiet system that keeps your family comfortable in the Texas heat and the North Texas winter.

CALL US TODAY FOR A HEAT PUMP INSTALL